US Tariffs (English)

Current status of US tariffs/punitive tariffs/reciprocal tariffs (Trump administration) as of 13.04.2025

Situation and data

Goods with Country of Origin "China" are subject to (at least) 145 % tariffs. Other tariffs might be added to that number (Section 301, ...).

The basic tariff of 10% remains in place! Section 232 tariffs (25% aluminum, steel, automotive) remain in place!

Under President Trump, the USA has introduced numerous (partly disguised) import tariffs. Let's take a look at the situation from the perspective of a European company.

We have built a tool that shows you the US (penalty) duties by entering the US customs code number:

Here a few csv files that list the affected customs code numbers (US customs code numbers!!). These are csv files - Microsoft Excel may not load them “natively” correctly. Load in Excel via “Data -> Import”.

(We did our best to check that all USHTS codes from the documents are included - but of course without guarantee)

Section 232 Tariffs (March 2025)

The tariffs levied on the basis of Section 232 take precedence over the so-called “reciprocal tariffs” described below (see section Reciprocal tariffs, Global Tariff - or: Carpet Bombing Tariffs). It is important to note that these Section 232 tariffs are not cumulative - i.e. they are not calculated in addition to other punitive tariffs, but are prioritized.

Product groups affected: Steel and aluminum

The measures not only concern the expected customs code numbers for crude steel and products made of steel or aluminum, as classified in chapters 72, 73 and 76. Rather, the application also extends to so-called “downstream products” - i.e. products in which steel or aluminum is used, but which are classified in other chapters, such as chapters 84, 85 or 90.

Customs duties are implemented at different levels of detail in the customs tariff system depending on the product group - sometimes at the 4-, 6-, 8- or 10-digit level. It is therefore particularly important for European exporters to check the exact tariff number of their products in order to avoid unexpected customs charges.

We have listed the affected headings (i.e. heading, 4-digit) for aluminum and steel here. As just explained, some of these headings are fully included - for other headings only selective (up to) 10-digit headings are included.

Aluminium:

Steel:

The following headings are exempt from the duties on steel:

- 7216.61.00

- 7216.69.00

- 7216.91.00

Meaning of the US nomenclature (HTS) for affected goods

The goods concerned are identified on the basis of the US nomenclature - the Harmonized Tariff Schedule (US HTS). Anyone who has systematically recorded and maintained the US customs code numbers used in the past for exports to the USA now has a clear advantage.

In particular, companies that have already stored the US customs tariff numbers used for their articles, products or materials - whether in ERP systems or technical documentation - can now assess the impact of Section 232 tariffs much more easily.

At this point, I would like to reiterate what I have been recommending for years: Even if the import is formally carried out by the US customer, a subsidiary or a sister company - European exporters should not ignore the import data in the USA under any circumstances. Only those who know and have documented the US customs code numbers can compare “apples with apples” in an emergency - i.e. precisely assess the actual impact and develop options for action.

However, if no actual (!) US customs code numbers are available, at least an initial orientation can be made using the European customs tariff number. Based on the first six digits of the EU customs code number, a preliminary conversion to the US-HTS number (6-digit) can be carried out. However, this should never be adopted without further verification.

There can be significant differences between the EU and US nomenclature even at the heading level (4-digit, so-called “heading”). In some cases, the classifications even diverge at chapter level.

Such differences occur, for example, with certain union nuts or evaporators for air conditioners. Correct classification is therefore essential - not only from a legal perspective, but also with regard to the assessment of potential customs risks and costs.

The correct customs code number (in the USA!!) is absolutely crucial here!

Customs duties on "derivatives" - Customs duties on "downstream products"

President Trump has introduced a key innovation with the new version of the Section 232 tariffs: Specific tariff code numbers have been included that affect more complex assemblies such as machinery, machine parts and electronic components. The aim is to levy tariffs specifically on the steel or aluminum content of these products.

Here are all Section 232 customs code numbers that fall into the "derivatives" category:

Import procedure

If a product falls under one of the customs code numbers listed, a so-called “split import” is required for import. The declaration to US customs is then made in two separate headings:

- Heading 1: The goods minus the proportion of steel or aluminum - i.e. only the remaining value of the goods, provided the customs code is included in the measures for steel or aluminum.

- Heading 2: The pure steel or aluminum content, whereby both the customs value and the weight must be stated exactly.

The specific penalty duty is then levied on the second heading- i.e. the metal content.

If this breakdown of the import cannot be properly carried out and documented (for example, because the supplier does not provide information on the metal content), the entire customs value of the goods is used as the basis for calculating the penalty duty. In such cases, the duty is therefore calculated at 100% of the value of the goods - with correspondingly severe financial consequences.

This regulation increases the pressure on companies to analyze their supply chains and product information particularly closely and to ensure reliable documentation on material composition and value shares.

In the case where the value of the steel content is less than the entered value of the imported article, the good must be reported on two lines. The first line will represent the non-steel content while the second line will represent the steel content. Each line should be reported in accordance with the below instructions.*

Non-Steel content, first line:

Ch 1-97 HTS, this same HTS must be reported on both lines.

Country of origin, same must be reported on both lines.

Total entered value of the article less the value of steel content.

Report the total quantity of the imported goods.

Report all other applicable duties, such as IEEPA tariffs and antidumping and countervailing duties.

Steel content, second line:

Same Ch. 1-97 HTS reported on the first line.

Same country of origin reported on the first line.

Report 0 for quantity for the Ch. 1- 97 HTS.

Report the value of steel content.

Report the Section 232 duties based on the value of steel content with HTS 9903.81.91.

Report a second quantity (of the steel content) in kilograms with the HTS 9903.81.91.

Report all other applicable duties, such as IEEPA tariffs and antidumping and countervailing duties.

„Country of Melt and Pour“ (country of origin of the metal)

In all cases, the country of origin of the steel or aluminum used must also be declared on the declaration - specifically: the country in which the metal was melted and cast (“Country of Melt and Pour”).

Currently, a distinction only has to be made between “US” and “OTH” (Other) in the customs declaration. However, it is foreseeable that a more precise indication in the form of the ISO country code will become mandatory in the future.

This distinction is crucial because:

- A 0% duty rate applies to derivative products that have been processed in a third country but are derived from U.S.-origin steel or aluminum that was melted and cast in the United States.

Companies must carefully check not only their suppliers but also their upstream suppliers with regard to the origin of the metal used and document the corresponding evidence.

Companies must carefully check not only their suppliers but also their upstream suppliers with regard to the origin of the metal used and document the corresponding evidence.

Expiring exemptions and lack of reimbursement options

Another important aspect concerns the so-called “General Approved Exclusions” (GAEs). These general exemptions from the penalty duty expire on March 11, 2025. This means that from March 12, 2025, products that were previously exempt will once again be subject to the full punitive duty rate of 25%.

No drawback procedure is provided for Section 232 duties. This means that no reimbursement of duties paid is possible in the event of re-exports or similar constellations. Companies must therefore assume that the burden is permanent and final.

Section 232 Expansion in the automotive sector (April 2025)

At the beginning of April 2025, the US government significantly expanded the scope of Section 232 tariffs: The focus is now specifically on goods and products from the automotive industry.

As with the previous measures, the scope of coverage is identified using customs code numbers. However, there is another decisive criterion: the use of the goods.

Directly recorded goods

Automobiles and vehicle parts classified under Chapter 87 are directly affected. The exact customs code numbers can be found in the download “Annex I Automotive”.

Indirectly recorded goods

In addition, numerous other products have been identified that are indirectly covered by the new measures - namely if they are intended for use in the automotive industry. Selected customs code numbers from the following chapters, among others, are affected.

Here, too, we have listed the affected headings for you - the customs code numbers actually affected can also be found in the documents, as the duties have been implemented at different levels of the customs tariff and therefore “penetrate deeply” in different ways.

Typical affected products include, for example:

- Hoses

- Data processing components

- Tubes and fittings

- Ball bearings

- Electric motors

- Gearboxes and gear parts

- and much more.

The combination of tariff classification and intended use makes the assessment of who is affected in this new area of application particularly complex. Companies should therefore take particular care to check whether their products fall under the extended Section 232 measures - and be able to document this.

Where-used list and import allocation

Some of the customs code numbers recorded already contain the use restriction “for Vehicles” in the US nomenclature. This facilitates the assessment. In other cases - for example ball bearings (8482) - the use is not evident from the customs nomenclature. Here, the importer must provide evidence of the intended use in order to prove correct classification and possible exclusion from the "Section 232 Tariffs".

Even if the intended use is already clear from the nomenclature, the customs authority can - as usual - request a classification decision or additional documentation.

In addition, a separate import split mechanism was introduced as part of the automotive expansion:

- Vehicles that are USMCA-certified (qualify for preferential treatment under the United States-Mexico-Canada Agreement) are generally exempt from punitive tariffs.

- However, the share of non-U.S. content is considered separately: A penalty duty is levied on this portion.

- Vehicle parts that are USMCA-certified also remain duty-free - as long as the certification is correctly documented.

The following customs headings were introduced for technical illustration:

- 9903.94.01: Applies to passenger cars and light commercial vehicles subject to duty.

- 9903.94.02: Covers vehicles that do not fall under the “Passenger Vehicles” category or are exempt from US content (0% duty).

- 9903.94.03: Refers to the percentage of non-US content in USMCA-certified vehicles (25% penalty duty).

- 9903.94.04: Duty-free for vehicles that are at least 25 years old.

- 9903.94.05: Applies to parts of passenger cars and light commercial vehicles subject to a 25% penalty duty.

- 9903.94.06: Applies to parts that are either USMCA-eligible or do not belong to passenger cars / light commercial vehicles.

Vehicles that are more than 25 years old are excluded.

Reciprocal tariffs, Global Tariff - or: Carpet Bombing Tariffs

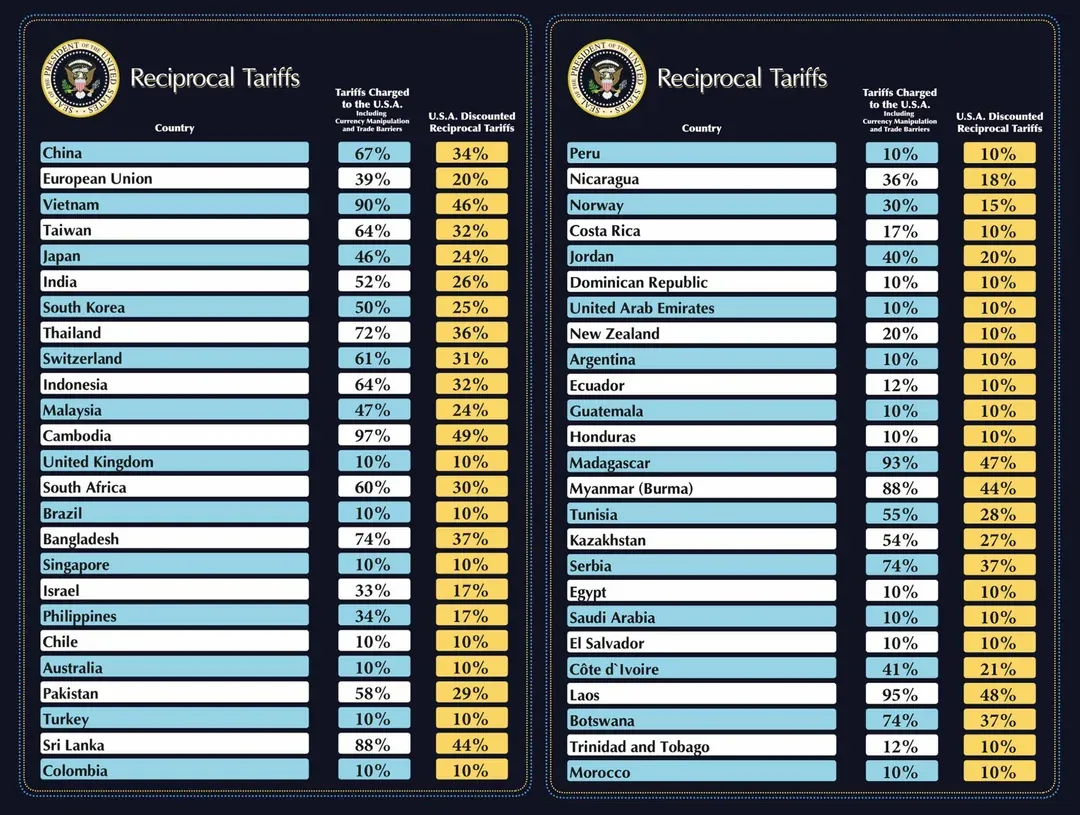

At the beginning of April, the US government decided to drastically expand its tariff policy: large-scale import tariffs were introduced on goods from a large number of countries worldwide. I have chosen the term “Carpet Bombing Tariffs” for this measure - a term that is intended to illustrate the breadth and severity of its application.

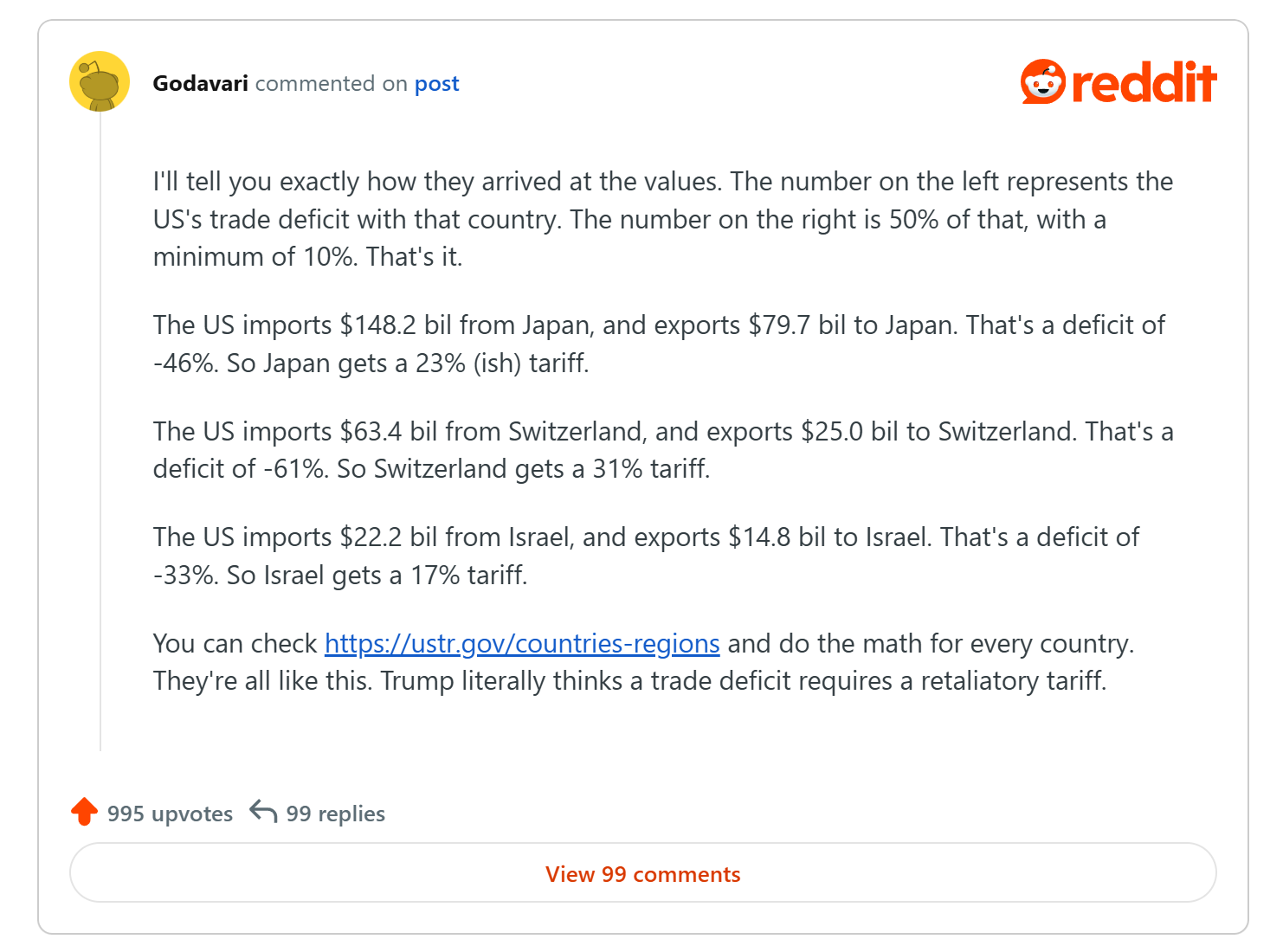

Calculation logic of the duty level

The official basis for calculating the specific tariff rates was not published by the US government. However, conclusions could be drawn as to how the rates are derived:

- The Trump administration calculated the trade deficit with the USA for each affected country - as a percentage value.

- This percentage has been halved - and the resulting figure is the duty rate that is applied to all goods concerned in that country.

Shout-out to Reddit user “Godavari” where I first discovered this information:

The approach lacks any economic or trade policy logic. Structurally, it predominantly disadvantages countries with low purchasing power or limited access to high-quality US exports.

A particularly drastic example: Cambodia - a developing country with a strong textile industry but low demand for imports from the USA - was hit with a flat-rate punitive tariff of 49%. This particularly affects labor-intensive sectors where wages are already low and working conditions are often questionable.

Product categories covered

The “Carpet Bombing Tariffs” apply to almost all goods, with only a few exceptions:

- Excluded are goods that are expressly mentioned in Annex II of the Regulation.

- Goods that are already subject to Section 232 duties are also not affected - as these are to be applied with priority.

Annex II identifies the exempted products on the basis of US HTS tariff codes. In total, this annex comprises just over 1,000 customs codes (distributed over 191 headings).

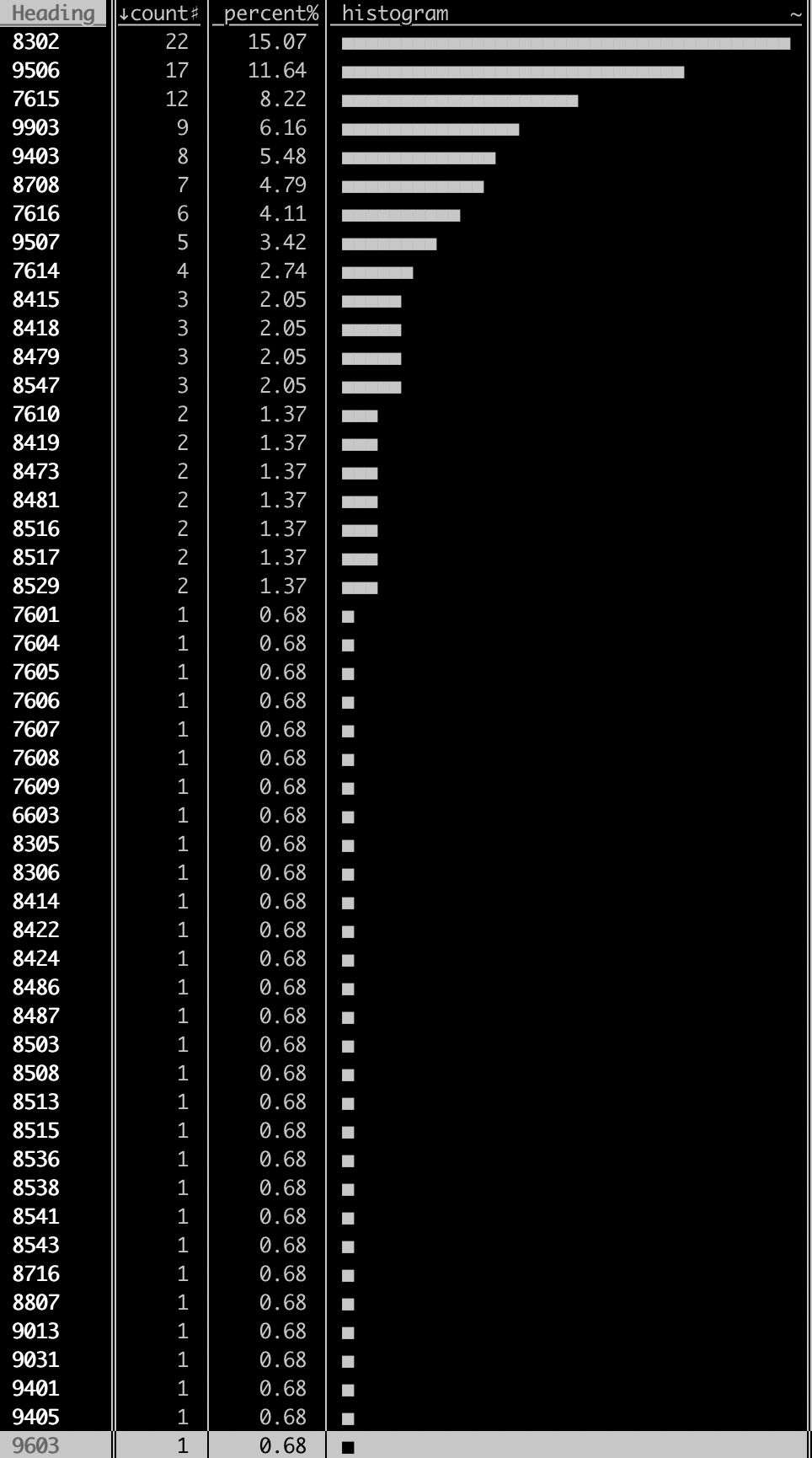

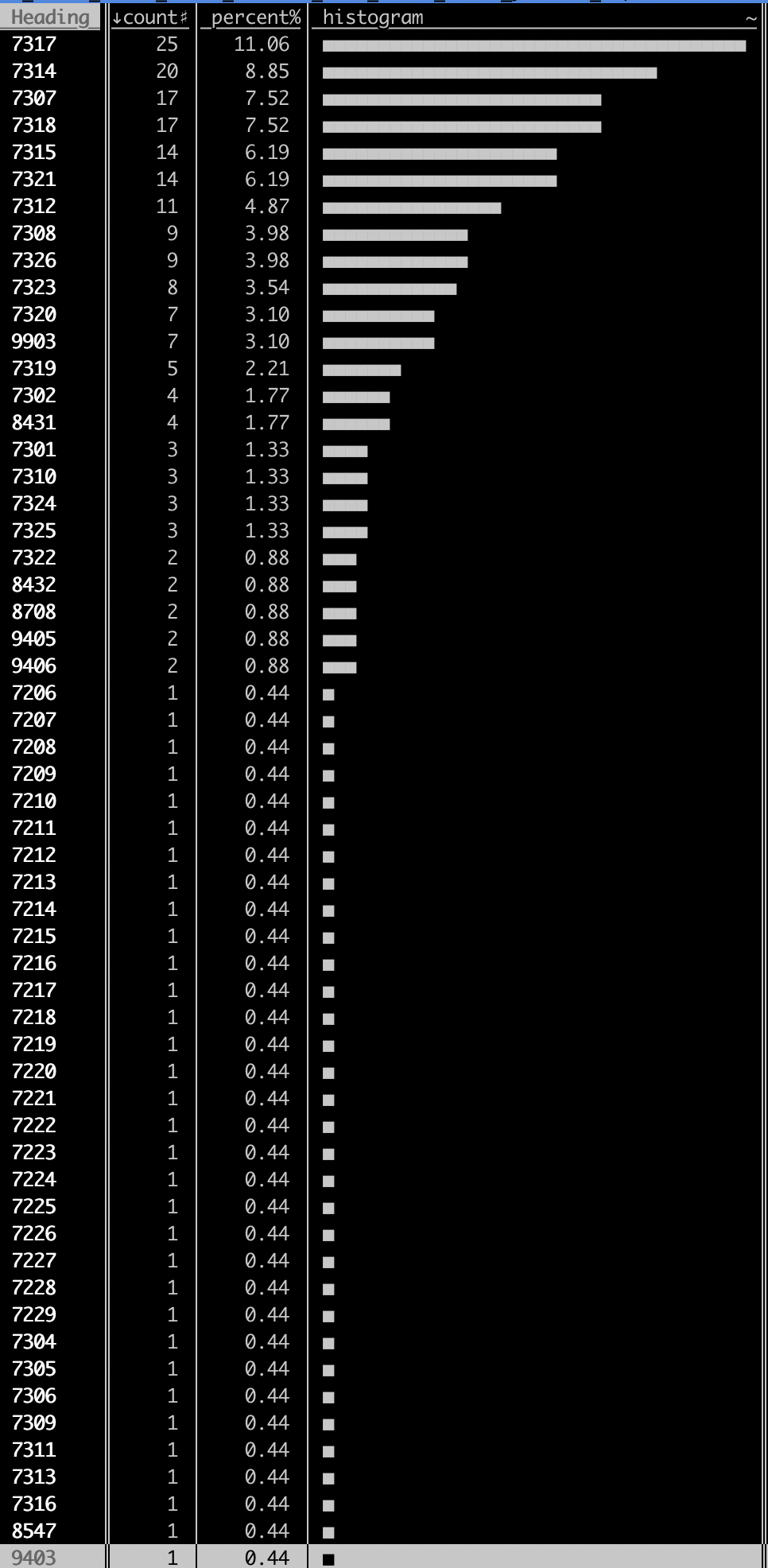

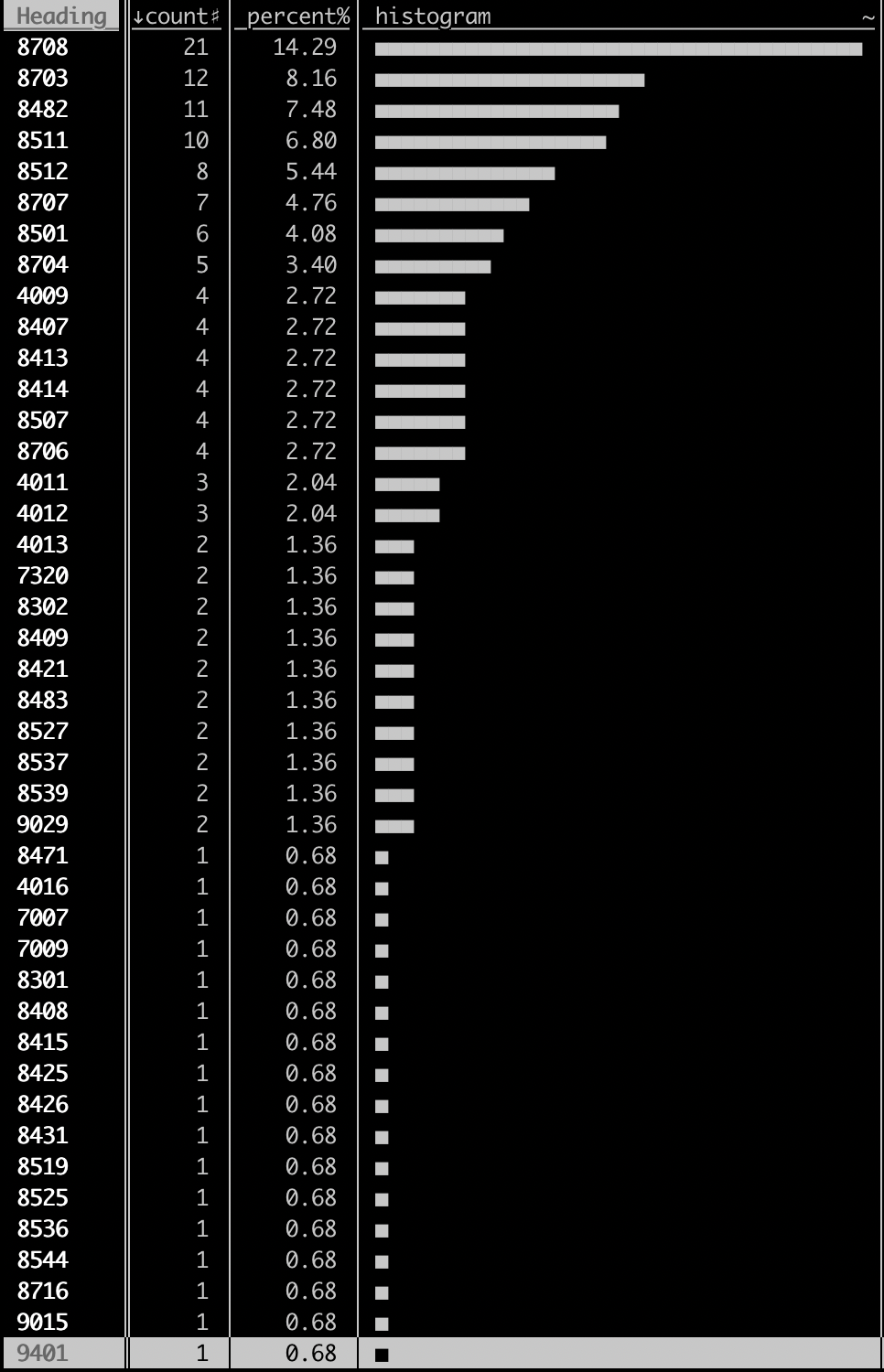

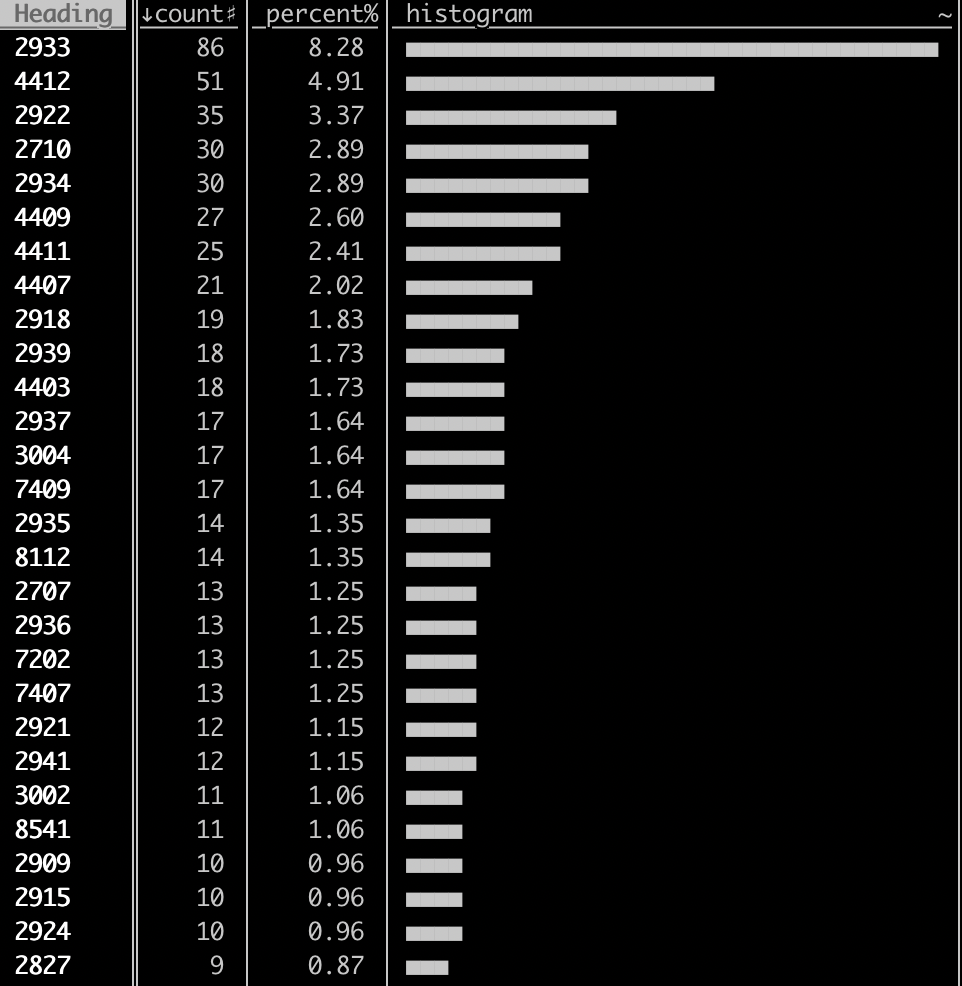

The chemical and pharmaceutical sectors are the most relieved. Only a handful of electronic components in the diodes / semiconductors sector are excluded from the “classic mechanical engineering chapters”. The top 28 headings based on the number of exempted customs code numbers per heading:

All remaining product categories – regardless of their classification or the sector involved – are subject to these newly introduced, country-specific punitive tariffs.

For European companies, this introduces an entirely new dimension of risk, as the impact is not only product-specific but also heavily dependent on the country of origin of the goods. As a result, documenting the countries of origin and reviewing potential exemptions listed in Annex II becomes a key compliance responsibility.

Customs duties per country of origin

| Country | Ad Valorem Tariff Rate |

|---|---|

| Algeria | 30% |

| Angola | 32% |

| Bangladesh | 37% |

| Bosnia and Herzegovina | 36% |

| Botswana | 38% |

| Brunei | 24% |

| Cambodia | 49% |

| Cameroon | 12% |

| Chad | 13% |

| China | 145% |

| Cote d’Ivoire | 21% |

| Democratic Republic of Congo | 11% |

| Equatorial Guinea | 13% |

| European Union | 20% |

| Falkland Islands | 42% |

| Fiji | 32% |

| Guyana | 38% |

| India | 27% |

| Indonesia | 32% |

| Iraq | 39% |

| Israel | 17% |

| Japan | 24% |

| Jordan | 20% |

| Kazakhstan | 27% |

| Laos | 48% |

| Lesotho | 50% |

| Libya | 31% |

| Liechtenstein | 37% |

| Madagascar | 47% |

| Malaysia | 24% |

| Mauritius | 40% |

| Moldova | 31% |

| Mozambique | 16% |

| Myanmar (Burma) | 45% |

| Namibia | 21% |

| Nauru | 30% |

| Nicaragua | 19% |

| Nigeria | 14% |

| North Macedonia | 33% |

| Norway | 16% |

| Pakistan | 30% |

| Philippines | 18% |

| South Africa | 31% |

| South Korea | 26% |

| Sri Lanka | 44% |

| Switzerland | 31% |

| Taiwan | 32% |

| Thailand | 37% |

| Tunisia | 28% |

| Venezuela | 15% |

| Vietnam | 46% |

| Zambia | 17% |

| Zimbabwe | 18% |

De Minimis Exemption – New Restrictions Starting in May 2025

The so-called De Minimis rule currently allows duty-free imports into the United States for goods valued under 800 US-Dollars. It applies to both business customers (B2B) and consumers (B2C) and has so far served as a significant facilitation mechanism in international e-commerce and shipping.

New Restrictions Starting May 2nd 2025

Effective May 2, 2025, far-reaching changes will come into effect:

- The De Minimis exemption will be eliminated for goods originating from China or Hong Kong.

- These shipments will henceforth be subject to one of two possible tariff charges:

- A 30% tariff on the value of the goods,

- Or a flat fee of 25 US-Dollars per item.

In addition:

- For shipments imported via courier services (not through the postal network), the new rules will also apply starting May 2, 2025.

Further Increase Starting June 1, 2025

Just one month later – on June 1, 2025 – the flat fee for goods from China or Hong Kong will be doubled:

- The flat fee will increase from 25 to 50 US-Dollars per item.

Potential Elimination of the De Minimis Rule for All Countries

The U.S. government has also announced its intention to reconsider the general De Minimis rule for all countries of origin.

Once technical systems are capable of efficiently capturing and processing import duties even for low-value shipments, the existing exemption threshold could be eliminated entirely.

If you've made it this far: my deepest respect! You've certainly earned yourself a coffee (or whatever you prefer).